Thanks @filthycasual. Certainly the moonboys are out and skewing the discussion one sided but thats why I would love to hear from the team, barring there is no legal risks.

In terms of documentation and detailed info with respect to API3, there are two general categories: that which can be publicly shared (most of which is found on the API3 github, website, and API3 docs), and that which is subject to non-disclosure agreements ("NDA"s, for example, just about everything with API providers at the moment, legal opinions (which will necessarily remain non-public)) or confidentiality terms in legal agreements. Should a DAO Proposal be passed that requires access to NDA-relevant, confidential or privileged documentation (with the API3 Foundation as a party), the actors in that proposal will need to similarly accede to an agreement with the API3 Foundation as the DAO’s legal wrapper, which promises to maintain the confidentiality. I will indeed work with such people/entities that enter into agreements with the Foundation to preserve confidentiality, as that’s part of my job as a counsel to the Foundation!

Philosophically, I think very few have any issue with easier access to API3 governance. Of course, participants should be familiar enough with web3 to be able to actually stake, vote and participate, and understand the mission of API-web3 connectivity, but the reasons for not discussing exchanges whether or not pending are primarily legal and regulatory: nothing good comes out of communications which are speculative in nature in a view towards token price, and at the end of the day, because centralized exchanges are… centralized… they make their own decisions as to listings despite the level of education, expenditure, cooperation, etc. involved externally. Part of being a compliance-focused project and protocol is exercising extreme caution where unknowns are present and speculation could arise which could damage a new/young DAO, as tempting as it may be to respond favorably to every community question.

To be clear, these are completely valid questions, which I was going to address on the next community call as important reasons for the legal wrapper: my job is to act in the interest of the DAO/Foundation – where confidentiality is required I preserve it, and I (and those others subject to confidentiality agreements) otherwise seek to open-source as much as possible to educate the stakers and wider community and build the ecosystem.

Hi Ugur,

Firstly, congrats to you and the API3 team for all the great work.

I am sharing my thoughts on both your posts

-

I fully agree that the project’s objective should be to attract investors to contribute to the DAO. Additionally, it is important to have the more patient crypto native investors, rather than moonboys, especially when the project is at an early stage

-

On the treasury diversification round. I do understand the benefit of liquidity, however would perhaps differ a bit, due to the following reasons

-

Equity and treasury are amongst the most important resources for any company / project,

and should be given out only in very important circumstances -

API3 team has done a great job in keeping costs under check and therefore a strong treasury. This

is a strong moat and should be conserved -

New investors also skew voting power, may have vested interests, etc

-

Cheers,

Ashish

Thanks @Erich. I look forward to hearing more on the bi-weekly call. Lawyers paragraphs are always a bit more difficult to understand in writing.

The way I understand is there is compliance/legal risks, so the team will wait for the venues to reach out and let them list out of their own will purely. I hear this is only applied to high volume pairs and the newly launched tokens that they consider promising but not yet listed elsewhere, like Yearn/CRV when they first launched. Even then, they need to have some form of interaction with the core team so I’m not sure which side sent the email first massively reduces the said risk?

Also, if we take the argument that reaching out to venues pose significant compliance/legal risks, doesn’t that mean majority of the large legitimate projects are also in deep trouble? I know a good amount of legitimate projects with large market cap and strong legal/compliance team reached out to Tier-1 venues first during the bear market.

Though the diversification round topic goes well with this topic, I suggest we create a new Sentiment Check post because my main point is not only liquidity provision but more mainstream exposure and easy onboarding. I’m actually very supportive of @UgurMersin’s earlier points about diversification round sometime in the future.

There is a lot to be discussed on diversification round as we can see from the current Sushi thread. @UgurMersin maybe you could start one? its just a sentiment check post not a proposal. I would much prefer that becomes the inaugural proposal by the DAO irrespective of passing than my OP post.

Reaching out/educating on the token and protocol/answering questions, etc., is not the risky aspect that is being avoided. The risk is in publicly declaring what is and isn’t in process so as not to create any speculative expectations (on a process that is in the counterparty’s control) which could feasibly be related to affecting token price, and to prevent breaching non-disclosure and confidentiality agreements.

I’m missing a holistic point of view here. As usual there can’t be just that oversimplification and therefore insult of an answer “moonboi, shut up” or even funnier: “nda! shut your brain up”, but it must be allowed to have an opinion. Even @Erich will have a personal opinion on what liquidity means and if it’s necessary or not and I believe he doesn’t break any NDAs just by stating an opinion. Kinda feels core team signed NDAs that forbid opinions then? Seen many NDAs but never saw such a thing in which personal opinion is penalized

What’s the question here?

To have liquidity or not.

- Having a liquid asset (or not) is not only some moonbois (idea of a) strategic idea but also operational necessity and IMO core team task. The team itself committed to DEX (and therefore liquid DEX) in the WP:

“The payment will be able to be made in any cryptocurrency, which will be received

by the DAO in API3 tokens through a liquidity pool-based decentralized exchange.” (5.4.)

If no liq then no consumers / users, because no one will want to pay you in API3 if it means massive slippage. Meaning if not enough liq then no healthy payment system. If liq falling regularly under some (tbd) threshold then surely no long-term trust by those who must exchange against API3 tokens. If liq would fall and stay for a long time under that threshold then forget about trust altogether and forever

Or was it planned that the DAO itself exchanges on DEX and suffers slippage?

- In the current situation exclusively LPing only on DEXes (putting the treasury API3s there) will create massive arb opportunities and you’ll just feed the arb bots. DaoV1 had provided some liquidity for CEXes, just not for Binance. I don’t care “if or when BN”, we just have to put additional liquidity in the already present markets (CEXes AND DEXes)

Probably a new proposal would be nice, something like “If total liquidity overall (CEX and DEX) falls under XX$ then add to ALL from treasury, balance it”

I agree with this. Any form of public discussion creates a speculative expectations so i’m not sure how we can even proceed further with this topic though. One side wants more constructive conversation on this. Specifically ‘yo man whats going on with this and your exact position on this? clearly something is not in a good state’ but the team can’t engage in this because of the above risk. So it seems like a stalemate here…

Best we can do is just do a proposal voting and see where the community stands outside the team? and if its in strong support, the team will try to take this onboard more?

Currently staking APR is 50%, and APR of largest API3 pool (API3/ETH on uniswap v2) is 25% minus “impermanent loss”. For sure that will cause liquidity to leave uni pool in favor of staking, so API3 will have even worse liquidity, if nothing is to be done in this regard. I would say there is no point reinventing the wheel here, just start typical uni v2 (or sushi, or balancer) liquidity mining program, alongside with the staking. It’s easy to find tested open source contract for it, could be done in no time. Alternatively, for better capital efficiency, but more work for developers - uni v3 liquidity mining. Deep liquidity on DEX will dampen volatility, improve visibility and perception of the project.

If noone has anything extra to add, particularly from the team, we should proceed to a proposal next week.

u dont seem to understand:

when a project hype up being listed on a T1 exchange the exchange does NOT list them . Crypto projects HAVE many NDAs that FORBID them from talking about the exchange and listing. Project have done this in the past and have been declined by places such as Coinbase and Binance. because they are looking for only pump and not real technology. it is risk for these exchange.

we know tis for FACT that API3 having direct line of contact with some exchanges (look at his VC investors). usually cryptos require a WORKING PRODUCT to be listed on T1 exchanges, and sign NDAs a long time in before. THE API3 TEAM KNOW WHAT THEY DOING, BUT CANT TALK ABOUT IT. OF COURSE THEY WANT THE TOKEN LISTED. WHEN IT READY - THATS WHY THEY DONT TALK ABOUT. REMEBER THEY HAVE VESTED TOKENS TOO

we dont want API3 to be a small pump/dump on some exchange, we want a slow increase that match with real use + fundamental and then when the project already has even more solid fundamentals we can expand more exponentially. this is the healthy option for the project. early speculation can kill projects and DESTROY public sentiment.

it very concernin and disapoint of community, nobody talk about open banking or other partner or other technical of project, but they want T1 exchange… you know API3 is governance token , we want knowledge crypto ppl first to spear head this project to success.

Hey, sorry for getting back to you so late with this, but i spend the last week in Paris at ETHcc.

It’s on my priority list to write something about this, since i have been thinking about it for quite some time. No promises as of when though!

I personally disagree with this approach because it will not create lasting liquidity. People will withdraw again the moment the amount that was put together for liquidity mining is used up. I think we’re looking at a much better approach if the DAO owns the liquidity and also gradually increases it. Again, this is something i have been thinking about for some time and i’ll make a post once i’m further with it. Also one thing to note with the APY, you’re not considering the locked vs unlocked rewards part.

Overall i want to finish this off with two statements:

-

An exchange listing and the liquidity issue are completely seperate things.

-

What a potential proposal means. (see below).

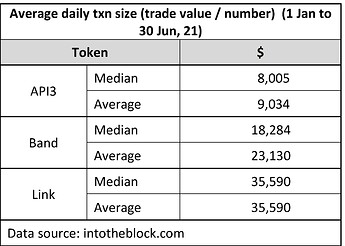

The topic of low liquidity problem has been raised a couple of times, by @AP13 and @UgurMersin , but perhaps been overshadowed by the listing discussion. I was curious to delve a little more into it. Sharing a quick list of what I saw, details are in the later part of this reply (apologies in advance, it will become a long post because of the data). For the comparison I mainly looked at Band as it is in a similar space

- API3 has generally been more volatile than Band and Link

- API3’s volume is concentrated with few exchanges. Across days I saw >50% daily volume with 1 exchange (OKEx) and >80% with top 4. Coincidentally all 4 are CEXs

- API3’s Liquidity appears to be low across marketplaces, incl OKEx

- I checked average trade size to see if that is creating price volatility. But API3 actually has a lower average trade size

There can of course be several reasons for this performance, low liquidity being one possibility.

My suggestion: We should first focus on increasing liquidity on exchanges where API3 is already available

How we fund it can also be discussed. The treasury is one option. Another one perhaps is the staked tokens. If we take the later route, only impermanent losses could be compensated, so the inflation through this route will be lower than one with open LP staking rewards.

Will be glad to hear the community’s views

The data

-

Higher volatility: 1 Jan to 30 Jun, 21 considered, to remove any impact of API3’s staking. Source intotheblock.com

API3’s price volatility

Band’s price volatility

Link's price volatility

-

& 3. Low liquidity & Sales concentration

a) We can look at: 1. The depth at 2% / 24 hour trading volume; 2. Liquidity score, 3. Top exchanges, at CoinMarketCap (API3 , Band ). Coingecko’s data is a little different but shows same trend

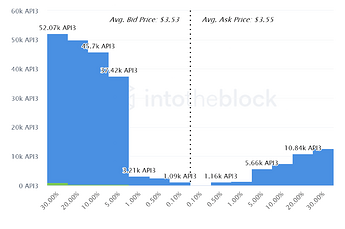

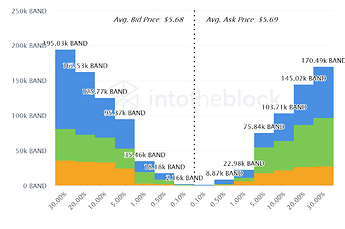

b) Exchange-Onchain Market Depth. Source intotheblock.com

API3

Band

- Low trade sizes

Thanks for sharing. Very informative with relevant data points. Could you start a new Sentiment Check thread? sooner or later people will always want to post something about exchange listings here so would not be good to get this thread get convoluted with liquidity provision, albeit they are both related to a good degree.

Very supportive of CEX (or DEX) liquidity provision as the next step.

Thank you @AP13 . I have created a separate topic, basis the community’s inputs we could move it to sentiment check and proposal.

This is the thread - Increasing exchange liquidity of API3

@UgurMersin Would love to get your views

For anyone curious, i’ve noticed in one of the cycle 4 budgets that the legal opinion work has not concluded from external parties. This is one of the required docs from a good number of venues, so for now, i will not make this into a proposal until the work is finished at a later date. I do think this thread has served well to gauge communities interest and sentiment, which i hope the team factors into their wider roadmap and strategy.

Do continue if others have any other constructive comments but i will be back at a later date on this if anyone was curious.

Regardless we should put this into proposal

I think it’s worth dropping a quick line in here to mention that we do care about your feedback and love the engagement. All concerns are valid and this particular issue is obviously important to us all.

Let’s strive for cohesive but constructive collaboration. I think @Erich actually gave a very good amount of input in describing our mindset on these things in one of his earlier responses when he said “Part of being a compliance-focused project and protocol is exercising extreme caution…” We are a compliance-focused project, this is why we exercise extreme caution.

We believe in this project. We live and breathe it. We’ve poured our blood, sweat, and tears into it. The last thing anyone wants is to succumb to some infraction on the compliance/regulatory side that kills the mission and vision we have worked so hard to achieve, and that we’re still working towards. That would be such a shameful way to go out, and yet we’ve seen this happen in this space fairly consistently.

I’d just like to point that out in response to some of the comments that seem to imply that maybe we’re being naive or somehow don’t understand how things work in this space. Leo Tolstoy once said “The two most powerful warriors are patience and time” and I think we should all keep that in mind when discussing things like this.