API3 DAO BD Team Proposal

Business Development Team Proposal, May 2023 – July 2023 (Cycle 11)

Team: Business Development Team

Operations cycle: #11

Period: 1 May 2023 – 31 July 2023 (3-months)

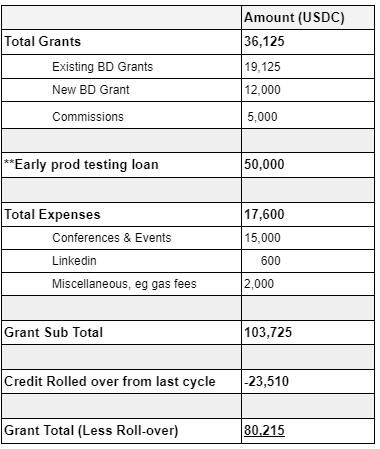

Amount: 80,215 USDC

Destination: Gnosis Safe (Multi-sig wallet)

address 0xB6124cE91E7ba6650791Bf969F94E31e2631cE86

signers: 2/3 Multisig

Dave - dav3.eth

Gio - 0x3afB3530Da3CBa4d8B278Af63872FAA80F1fC87D

Kevin - 0x676f0341FC230dD28455A5B32b28651ACC377c88

Scope

The Business Development team (BD) drives holistic organizational-wide value within the DAO. API3’s vision is to be the first choice in DAO-governed decentralized data oracles, dAPIs [Decentralised APIs i.e. price feeds and OEV (Oracle Extractible Value] and QRNG (Quantum Random Number Generation) for Web3.

Our purpose is driven by on-chain verifiable truth, facilitated by our technology stack.

Our tasks extend to forging partnerships, seeking synergies, creating sales pipelines for the above described products. We have directly and indirectly grown value by $150,000 +, more explained below. We have taken intangible deliverables and translate this into ROI.

The BD team is further exploring new ways to achieve incentive-orientated decentralization and more towards DAO autonomy.

For the purpose of this proposal, BD’s general responsibilities encompasses these overarching responsibilities that relate to:

-

Sales process

- Outreach

- Continuous improvement of outreach processes

- Exploring decentralization strategies

-

Recruitment & HR (In-line with product growth and dAPI scaling)

- Onboarding

- Training

- Best practice

- Ongoing support

-

Coordinate with the marketing and ecosystem sub teams

- Help with ecosystem outreach and activities

- General networking and on-the-ground interactions

- Articles, blogs and content

- Liaising with other relevant API3 sub teams

- Attend conferences and workshops

-

R&D

- Technical-side feasibility of integrations

- Business-side feasibility assessment

- Customer and market sentiment analysis and feedback

-

Internal workshops and meetings

- Attend mandatory sub team and team meetings

- Knowledge dissemination and internal knowledge workshops or materials

Team Movements

- No team movements or additions.

- We have restarted passive recruiting.

1.BD - Enterprise & Provider Focus:

Gio has been engaging with large organizations over the last few cycles. He will continue to allocate his time developing partner and provider relationships, which are key for the development of dAPIs and OEV. In addition to these tasks and working alongside Dave and Kevin, he will assist in overall BD growing out the pipeline, interactions and autonomous functions for the BD mid-term vision. Gio will update us on any enterprise movements and large deal flows (some are still in progress or in slow-down given the macroeconomic outlook), as well as, any PoCs of Pilots when they are complete.

Completed Deliverables (Cycle #10)

Following-through from the previous update, the alphabetical numbering is mapped and reconcilable to the previous proposals for your reference e.g. (A)-(Q) :

-

Update 1: A large market data provider (A) - status: on hold - pilot delivered.

- We are working with a perpetual dApp to deliver this pilot, linking the data source (supply) to the demand (dApp) via the API3 tech stack to facilitate a fully functional PoC for the large provider.

- There has been a change in leadership due to a merger at this provider, thus, the pilot has been delivered and is stuck at the testing and feedback phase.

-

Update 2: A large financial data institution (B) – status: still engaging

- We are meeting their team again in Q2 to discuss a more serious engagement when it comes to their data oracle strategy.

- I will arrange a meeting at Consensus.

-

Update 3: A large-size crypto market data provider (K) – status: follow-up

- Will arrange to meet at Consensus

-

Update 4: A medium-size market data provider (N) – status: moving forward

- Datasets: Forex and Equities.

- Technical testing passed.

- At final stages of legal review before deployment.

-

Update 5: A large financial data institution (O) – status: early engagement.

- On-going rapport building.

- Will meet at Consensus or Token2049 again this year.

-

Update 6: A large asset manager (Q) – status: early stage, initial discussions

- Discussed OEV and data oracle related applications.

- Will meet again at Consensus.

Closed or cold interactions:

-

Update 7: A large-size crypto market data provider (H) – status: closed.

- Lead went cold.

-

Update 8: A large enterprise blockchain provider (I) – status: closed.

- We could not find a mutually beneficial outcome in the vendor agreement, with the deal falling through.

- We will assist this large enterprise blockchain on an adhoc basis, as there is interest in the QRNG service.

-

Update 9: A large-size crypto market data provider (L) – status: closed

- Dataset: Crypto

- The provider did not meet our stress testing requirements for aggregated price feeds.

-

Update 10: A medium-size market data provider (M) – status: closed

- Dataset: Crypto

- The provider passed the technical test, signed, deployed and is providing data to dAPIs

-

Update 11: A medium-size market data provider (P) – status: closed

- Datasets: Crypto, Forex and Equities

- The provider passed the technical test, signed, deployed and is providing data to dAPIs.

-

Update 12: Outreach to 20 market data providers (R) - status: closed

- Completed the sales cycle for the outreach

- Resulted in 4 new interactions currently in discussions.

New engagements over the quarter:

Update 13: Over the quarter, Gio and Mertcan (technical lead), tested, approved, signed and deployed 7 providers. There are still three in the pipeline to sign and deploy over the next 45 days.

- Furthermore, one additional provider(i.e.a well-known crypto brand)is at the initial discussion phase. We hope to get them onboard before Phase II roll-out.

For Cycle #11, no new enterprise engagements will be prospected. Rather, the existing ones followed-up and closed. The focus will be on getting these last few providers over the line and driving interactions around OEV, QRNG integrations and exploring new ways for BD to achieve greater autonomy and programmability.

Deliverables (Cycle #11)

Gio’s goal is to close out the above interactions and provide feedback on these outcomes. In addition, to find market data providers, so that dAPIs will have better quality and robustness for their aggregation and selection. The optimal number of providers would be 10. Gio is close to attaining this target. Gio will be shifting his attention to QRNG, dApp outreach and general BD sales to assist the team this quarter.

As per the previous proposal, the approach to onboarding providers is the following: gauge a provider’s interest; get access to a test API to do compatibility and calibration testing. Once the technical team is happy with these stress-test results, discuss and sign commercials and lastly, self-integrate the provider (via ChainAPI). The commercial elements include a revenue-sharing model.

Provider goals:

- In Cycle 10, 7 providers underwent testing, deployment and are ready-to-use for dAPIs. These providers collectively cover crypto, forex, equities, commodities and indices tickers.

- In Cycle 11, the goal is to onboard and deploy the last 3 providers, bringing this total to 10 providers. The focus of which would be adding providers that cover multi-asset classes, including commodities and indices data.

BD Autonomy Exploration

- For the previous quarter, Gio, Dave and Kevin spent time exploring conceptual ideas around floating the BD team in a more decentralized and autonomous fashion.The purpose of which is to align with the ideals of the DAO itself, decentralized-autonomous-value-creation.

- We are still exploring this concept which is technically complex, as it relies heavily on game theory to self-direct incentives that create outcomes in a way that replaces part or all of a centralized management system.

- During these discussions we found a theoretical way to utilize a ve(3,3) model to ensure that dAPIs always remain funded with gas. We will make this short piece available in the next few weeks.

- Post this article, we will delve deeper into decentralizing BD, in the sense that anyone, with a passion for data oracles can participate, add value and be remunerated accordingly.

Self-funded dAPIs are now live, and cycle 11 will involve recruiting users for them, it makes more sense to divide the blockchain side up into the two separate products, QRNG and dAPIs, with both encompassing different aspects of the dapps/platform side of BD.

2.QRNG

Dave has been spearheading the QRNG and dApps & Platforms outreach. In addition to his niche, Dave will focus on general BD alongside Gio and Kevin.

Completed QRNG Deliverables (Cycle #10)

QRNG Deployments

Cycle 11 showed a dramatic uptick in usage of QRNG, and thanks to the dAPI subteam and Aaron, we now have a public dashboard for this, available at monitor.api3.org. No additional chain deployments were possible over this cycle.

QRNG Usage

QRNG total usage over this cycle is over 125k requests.This real-time dashboard shows the breakdown of the requests across various blockchains.Over the last 30 days, usage was divided between chains as follows (at the time of writing):

- Moonbeam - 28.94%

- Arbitrum - 23.13%

- Arbitrum Nova - 37.91%

- Polygon Mumbai - 6.24%

- Other - 3.78%

QRNG Users

The following projects have announced their usage of QRNG during this cycle. Note that it is likely more projects are using it, but we operate it as a public good so there is no need for projects to ask us to use it, or tell API3 that they are. The projects below are ones that have contacted us or tweeted about using QRNG.

-

Arcadeum - https://arcadeum.io/

-

Peak Finance - Lottery - Peak Finance: Documentation

-

The Gainlings - https://twitter.com/thegainlings?lang=en

Grants Received

The BD team negotiated grant payments for QRNG deployment across two chains, and received $30k for this. This will remain in the BD multisig, and be used to fund operational expenses for QRNG, as well as future QRNG development work.

API3 also received a 75k ARB grant from Arbitrum, as part of the ARB token distribution, for being part of the Arbitrum ecosystem. This will be subject to a future proposal, and is being held by the dAPI multisig on Arbitrum One.

Total revenue from cycle 10 therefore was approx $150k of revenue. The BD team, in addition to its other duties, continually seeks extra ways to bring revenue into the DAO.

Deliverables (Cycle #11)

Although QRNG is a public good, we still believe that it helps our BD and ecosystem teams, and is still important to support. We believe QRNG acts as an important tool for awareness of API3 generally, and familiarizing developers with the first party oracles concept, as well as the request-response protocol and the API3 ecosystem. For cycle 11 the BD team will be paying commission, included in this proposal budget, for BD work leading to successful QRNG dapp integrations, which will also be a deliverable for the next proposal. The main focus of cycle 11 and 12 will however be on dAPI usage, rather than QRNG.

The BD team believe that through expanding QRNG to more chains, developer awareness of API3 will increase, and plan to help the ecosystem team deploy to currently unsupported chains where possible. The benefit of supporting additional chains will be assessed on an ongoing basis, and extra deployments conducted where developer resources are available, and the benefits felt worth their allocation.

For cycle 11 the BD team will be paying commission, included in this proposal budget, for BD work leading to successful QRNG integrations. A flat $1k per integration is available on an ongoing basis.

This is intended for BD team members working on dapp outreach, but will also be available to other DAO members who can deliver integrations on a discretionary basis.

3. BD – OEV and dAPIs

Completed Deliverables from Last Cycle

- CRM planning

Integrated CRM and various contributors to that CRM so we can track outreach more effectively. Tools like Linear and Hubspot have been used and implemented to track the sales pipeline across the BD and ecosystem team.

- Commission Survey/Structure

A commission structure has been developed that will enable us to scale various parts of BD, and to reward performers for delivering results that advance API3’s interests. In a fast-moving environment, this isn’t all-encompassing of the work that will be required, however it is a foundation to work off of.

- Research

Various models have been explored that can add to the monetization, usage, and eventual full decentralization of API3. Due to the evolving nature of our offering, this will be an ongoing objective and will culminate when we get closer to accomplishing our current roadmap.

- Conferences/Engagements attended

Pantera San Francisco, ETH Denver, and Consensus in Austin.

- Early Integrations

Work is ongoing with projects looking to integrate API3, and these will be announced when appropriate. $50k has been requested in this proposal, which will be used for some initial production testing of these applications. This is intended to be returned to the DAO, with profits if applicable, when this early testing is finished. While the nature of testing involves potential loss of funds, every precaution will be taken to ensure risks are minimised.

Upcoming Phase: (April -)

Action Items:

-

Due to the release of zkSync and zkEVM, efforts will be best spent supporting new dApps looking to integrate on these chains. Working closely with both zk teams, we want to become the oracle of choice for any dApp looking to launch there. A goal of this cycle will be to further these relationships to the point where a sponsorship for Managed Feeds makes sense.

-

Gather data and collaborate with the Ecosystem team to make results of early dapp integrations public as more products launch, with the aim of quantifying benefits of using API3 over competition.

-

For many dApps this will be a long sales cycle. Creation of an ‘Early Adopter’ program will allow these projects the time to get comfortable and will allow us to take them step-by-step until they are fully integrated.

-

The primary goal of this cycle will be to continue to lay a foundation of usage to support our wider sales push

Business Development Budget

Figures that are (-) are surpluses while (+) are funds requested from the DAO Treasury.

**$50,000 is requested for testing dapps entering early production. It is intended that after this is finished, the funds, plus any yield generated, will be returned to the DAO. Feedback from testing will be communicated to the technical subteams as well as the dapps where necessary. While the nature of testing involves potential loss of funds, every precaution will be taken to ensure risks are minimised.

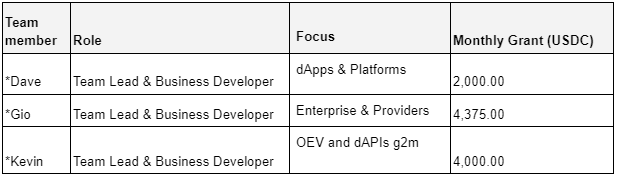

Team and Grants

The team is composed of Business Development personnel.

Commission Structure Cycle #12

BDs remain on a base grant until Phase II roll-out, thereafter, we suggest that a commission only structure will apply and will request to the DAO to allocate 200k API3 tokens to incentivise and drive deal flow and closure. The sales cycle is generally longer due to the technical nature of the product and the ‘value-risk’ of switching costs, thus, we have already started the sales pipeline from last quarter.

The requirements or KPI would be to sign 12 dApps or grow the total value secured to $100m from these signings collectively. The commissions will be assigned on a pooled, team basis for meeting this joint outcome aligning and driving teamwork while ensuring individual performance. The 200k API3 token request will be made in the next prospal, cycle #12 while we move current interactions forward towards the above KPI with work done from Cycle #10 onwards counting towards this goal.

The reason for basing BD compensation on this metric is to ensure that BDs are incentivized to ‘hunt’ and close deals as a team, while adding direct benefits to product uptake and awareness.

Expenses

The team will kick-start passive recruitment of business developers on a contractor basis. Please apply, as we will be reviewing resumes on a rolling basis for Phase II and beyond.

Ad-hoc commissions being paid to external individuals for introductions resulting in a positive outcome for the DAO will also be factored into the commission budget (an example being valuable warm intros leading to dAPI usage).

The business development team will also be attending events as indicated as critical to drive new partnerships and ecosystem growth. Conferences and events that fall outside of large Marketing team sponsored events will be funded by the business development teams grant budget as per the Travel Reimbursement schedule.

Over the next quarter Dave and Kevin will be attending the ETHCC in Paris , The Blockchain Oracle Summit and CryptoEconDay in July and Gio and Kevin will be at the Consensus Austin Conference in April. Other events on the BD team’s radar are Token2049, SmartCon, The Science of Blockchain Conference at Stanford, and ETH Barcelona.

In addition to the conference expenses, the team will potentially need access to tools to help streamline the BD pipeline. Some specific examples (not an exhaustive list) are:

- HubSpot & Linear

- Docsend

- LinkedIn Premium (Prospecting or Job Posting)

When tools or features are chosen, receipts will be kept for production at the end of the cycle. Any remaining expenses will be rolled over to the next cycle.

The final category of expenses is for on-chain transactions in disbursing grants payments and such as creating proposals in other DAOs. Transaction IDs will be retained for these and produced at the end of the cycle.

Any unspent amount will roll over to the next cycle.

Explanation of Proposal Parameters:

- Target contract address is the USDC token contract address, which is 0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48

- Target contract signature: transfer (address, uint256). This is the function to call on the target contract, which triggers a transfer of USDC tokens.

- The parameters stated include the address these USDC are to be sent to, which should match the proposal address, followed by the number of USDC. USDC has 6 decimal places, and solidity is unable to deal with decimal places - hence we add 6 zeros after the proposed USDC number. The number of decimal places can be verified on the USDC contract page of Etherscan - $1.00 | USD Coin (USDC) Token Tracker | Etherscan