Here is a draft of our proposal. It’s going to be left up until Thursday for comments before being pushed on-chain. Looking forward to your feedback.

I tried to keep this consice.

Mission 1B20N24 Proposal #2

Period: December 2023 – February 2024 (3-months)

Amount: 1,299,968 USDC

Destination: Gnosis Safe (Multi-sig wallet)

Address: 0xa742e1d181c59c9c4dd5687172efc119e3868d09

# Recap of Last Cycle

The last cycle brought with it a significant change in structure. For the first time since DAOv1 days nearly all DAO contributors were united under a common banner. Expanding dAPIs to a lot of chains and reading the overarching goal of 1 billion TVS in 2024. We’ve taken significant steps towards making that reality, despite the fact that TVS numbers on Defillama might not reflect at current times. We’ll categorize the developments into technical, marketing, ecosystem, and business development.

On the technical development front, we’d delivered five new chain deployments (Kava, RSK, Base, Mantle and Linea) and introduced a new dAPI category in LSD Exchange rates. We’ve also released a new API3 Market adjusted to our new branding. Most of the efforts however went into things that aren’t visible…yet. We’re working on something called Phase 2.1 and obviously the elephant in the room called OEV Share. We’ll be diving into both further below talking about the upcoming cycle goals.

In terms of marketing the focus of last cycle was creating common messaging and standardization of our materials. “Verifiable, Decentralized, Straight from the Source” is messaging that you’ll be finding consistently across our materials now. We’ve also prepared templates to announce e.g. new chains, new data providers or new dAPIs. Most of these are also visually standardized with videos for new chains (like Mantle) and new dAPIs (like GNS/USD). Our medium has gotten a little rework and is condensed to the most important We’ve also had a very successful presence during the Devconnect week in Istanbul, with booths at L2Days and ETHGlobal Istanbul together with a bunch of other side events. Our merch designs were the hit, and you were seeing random people in Istanbul running around in an API3 Hoodie!

Ecosystem was also a major contributor to the success of Istanbul by engaging our partners as well as helping out hackers utilizing API3 during the hackathon. Apart from Istanbul, we’ve also been busy at ETH Chicago and ETH London helping developers utilize API3 wherever they can. QRNG Deployments were also extended to Mantle, Linea, Base as well as Scroll and workshops were given with our chain partners like Linea and Arbitrum.

Lastly, to the topic of business development. In the last cycle partnership announcements with dApps like Kinetix and Granary Finance were made and our TVS according to DefiLlama currently stands at 13.5M. This number is going to be growing soon, as numerous announcements and integrations are pending. When it comes to user acquisition, things tend to take a little longer. Projects need to test dAPIs, then integrate them, have pending audits, coordinate marketing and launch efforts. While we cannot announce who is going to be announce, we can promise that they are going to be revealed the moment they go live, and projects will be added to our DefiLlama Dashboard as soon as possible. The fruits of our labour in terms of business development in this cycle will only really be showing in the next one.

# Upcoming Cycle

The upcoming cycle has two major themes: OEV Share and Phase 2.1

Phase 2.1 is, as the name might suggest, an improvement upon Phase 2 – managed dAPIs. Managed dAPIs work as intended, the product works smoothly and together with the API3 Market is a one-of-a-kind solution in terms acquiring oracle services out there. However, in the past months we’ve realized that we need things to scale, even more so than they already do. For instance, when a user acquires a new managed dAPI, it typically takes us a couple of days to spin it up. Or, if we want to integrate a new chain, it will take us a couple of weeks to do so.

However, with the rise of RaaS providers and the likes of Polygon and Optimism making it possible to spin up your own chain with Polygon CDKs or the OP-Stack, a new reality became evident to us. We have chains reaching out nearly daily and there is no way that we will be able to expand to all of them quick enough in the current setup and have any chance to keep up with orders coming in from all of them. The reality of things is we’re going to be dealing with over 50 chains in a year and potentially a new order every single day. There is no way to scale this in our current capacity without hiring five times the amount of people to keep up. Unless there was a way to do so technically?

While we cannot yet disclose how exactly Phase 2.1 will look in detail, we can dive into what it will enable. Chain deployments will go from weeks to mere days and buying a dAPI on the API3 market will immediately and automatically activate it instead of requiring manual implementation for a couple of days removing any type of overhead that might have been attached to that. Receiving oracle services will truly be like subscribing to Netflix or Spotify and immediately begin using the service. Phase 2.1 will bring allow us to scale to numerous new chains who are eagerly awaiting us now. It is also the main reason we haven’t completed any new chain deployments since our recently announced five. Thus far, we’ve amassed a pipeline of 40 chains waiting for deployments.

What about OEV Share? The next cycle will be all about OEV Share. We’re getting really close and want to spend the next cycle paving the way towards OEV Share with ETH Denver acting as the pinnacle of this build up. This isn’t a promise of launch in Denver, but it’s also not saying we potentially wouldn’t! We had a very successful week in Istanbul and want to repeat things in Denver while presenting something we worked on quite a while to the greater Ethereum Community.

All of this doesn’t mean there will be nothing happening on the dApp front. Numerous dApps that have been testing and auditing in recent weeks should be ready to launch, adding to our TVS. Some others are waiting for feeds that will become available once Phase 2.1 is released, again adding significantly to our TVS. We’re going to be releasing more about these once they materialize.

Finally, the UX/UI team will be absorbed into the “1B20N24” proposal, continuing the path of consolidation and value alignment across the DAO.

# The Numbers

When it comes to the previous cycle, our expenditure was within expectations. Some unaccounted expenses in terms of obligations from previous teams caused us to spend more than anticipated in combination with a presence at Istanbul that turned out to be a little larger than initially expected.

Overall we’ve spend $957,731.66 from the initially budgeted $884,630, which made us tap into the 10% buffer ($973,093 TOTAL + Buffer). This leaves us with 15,361.34 in remaining funds after all remaining obligations for this cycle.

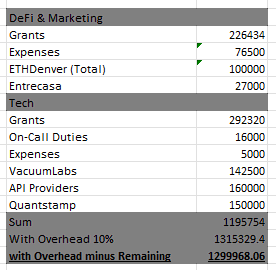

For the upcoming cycle expenses will roughly stay the same with the difference that Istanbul will be replaced for Denver, as well as the absorption of the UX/UI Team and their overheads. Additionally, there is a audit package totalling $150,000 that will be added as a one time expense that buy us 10 weeks of auditing services with Quantstamp for any upcoming audits in regards to Phase 2.1 as well as OEV Share.

The grants are covering a total of 30 people, totalling $172,918 monthly, or $518,754 throughout this proposal. In addition to this number, we have Entrecasa as creative support as well as multiple people from Vacuumlabs that help on the technical front, which brings our overall headcount closer to 34. API provider expenses are covered in this proposal as well as technical rotations in regard to dAPI operations. ETHDenver is budgeted with around $100,000 of which $65,000 is reserved for the sponsorship, another $15,000 for merch and side events as well as $20,000 to cover travel expenses.

As usual we’re incorporating an overhead of roughly 10% to account for any unexpected costs arising.

In addition to this, we’d like to request 75,000 API3 tokens from the hotwallet for bounties for the ETHDenver hackathon as well as marketing activities related to the buildup of OEV Share.

# Explanation of Proposal Parameters:

The destination will be a multi-signature wallet address managed by Burak, Andre, Ashar and Ugur.

Target contract address is the USDC token contract address, which is 0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48

Target contract signature: transfer (address, uint256). This is the function to call on the target contract, which triggers a transfer of USDC tokens.

The parameters stated include the address these USDC are to be sent to, which should match the proposal address, followed by the number of USDC. USDC has 6 decimal places, and solidity is unable to deal with decimal places - hence we add 6 zeros after the proposed USDC number. The number of decimal places can be verified on the USDC contract page of Etherscan - $1.00 | USD Coin (USDC) Token Tracker | Etherscan